St. John Properties Reveals Strategy to Redevelop Harrisburg Mall into Swatara Exchange

Demolition of mall will pave way for mixed-use business community supporting up to 1,000 new jobs and approximately $1 million in additional tax revenue annually.

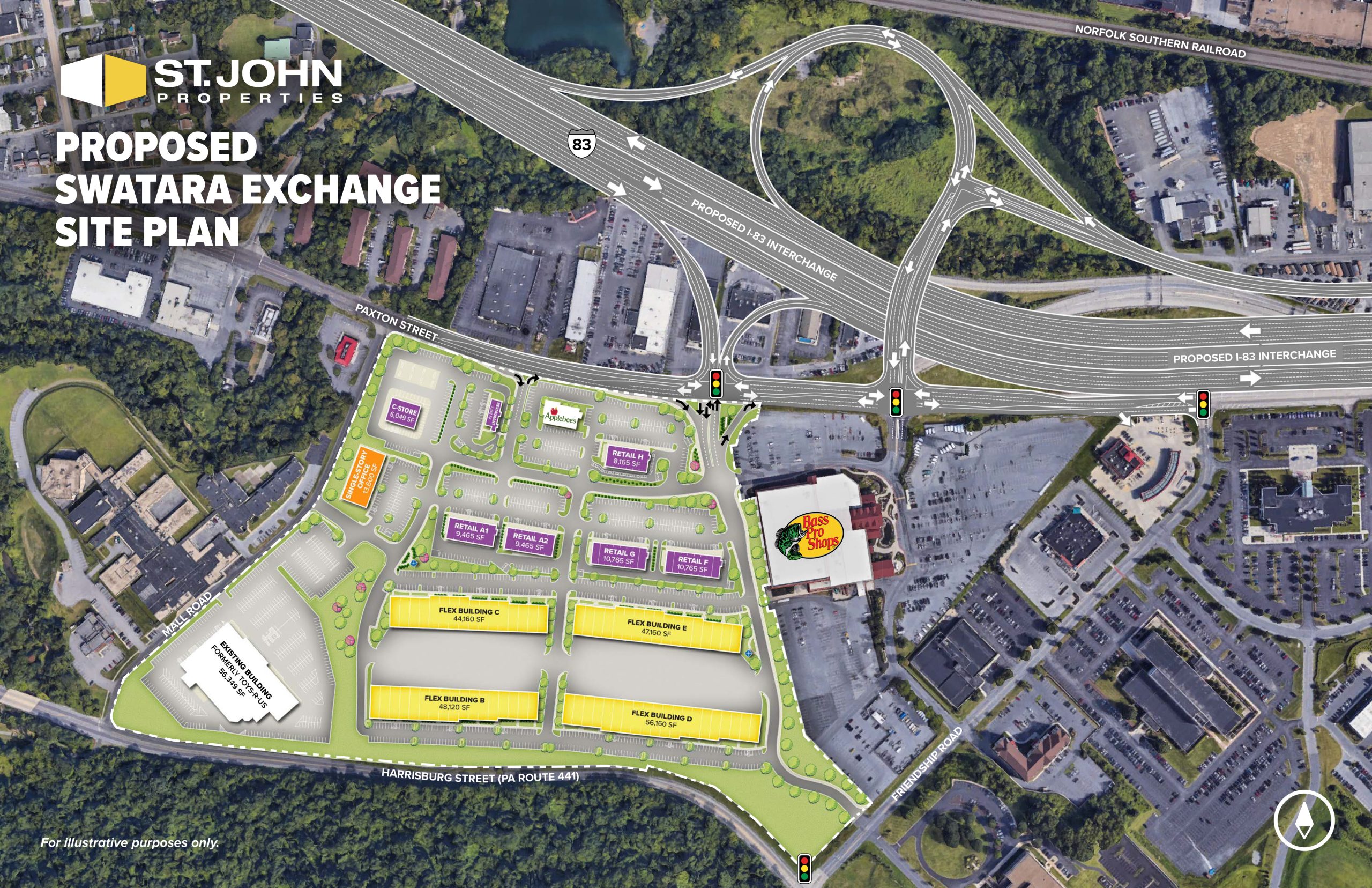

BALTIMORE, MD – St. John Properties, Inc., a Baltimore-based commercial real estate development and management company with a national portfolio valued at more than $5 billion, has revealed its redevelopment strategy for Harrisburg Mall, a one million square foot regional mall located in the Swatara Township section of Dauphin County, Pennsylvania. Following an extended demolition program that is expected to conclude in 2025, the company plans to embark on the development of Swatara Exchange, a mixed-use business community containing single-story office, multi-use/flex space, and supporting inline retail and retail pad sites. The existing Bass Pro Shops and Applebee’s Grill + Bar Restaurant will remain operational, and the former Toys R Us building will be marketed for a new use.

At full buildout, Swatara Exchange is expected to support up to 1,000 new jobs in its nearly 550,000 square feet of space, and contribute approximately $1 million in additional tax revenue annually. Twelve new buildings, including two retail pad sites, will be constructed in total.

“When formulating our long-term strategy for Harrisburg Mall, we factored in trends occurring throughout the retail industry, changing consumer shopping patterns, the local real estate landscape, and the greater Harrisburg economic climate,” stated Lawrence Maykrantz, President and CEO of St. John Properties. “It was extremely important that we satisfy Swatara Township residents, Dauphin County taxpayers, and the regional business community. After careful consideration, research, and planning, we believe we have arrived at a solution that leverages our company’s strengths and experience, and which will provide long-term value and benefits to the community.”

Development plan and expected timeline for Swatara Exchange

St. John Properties’ development plan entails the construction of 13,600 square feet of single-story office space and nearly 200,000 square feet of single-story multi-use space, which the company classifies as ‘flex/R&D.’ This latter building type became a trademark of St. John Properties in the early 1970s in response to the real estate needs of a wide range of end-users. It consists of a “part office/part industrial” single-story building separated into bays which can be fully customized based on the users’ requirements. The product, equipped with 16- to 18-foot ceiling heights, 30-foot wide bays, 80- to 100-foot building depths, rear service courts for truck loading, and abundant parking, can be leased as a single-bay or in multiple bay units up to an entire building. The space is easily adaptable to accommodate a wide array of end-users including professional services, medical, wholesale, light manufacturing and distribution, scientific research, and early childhood education. St. John Properties currently develops and leases this flex/R&D asset class in nine states across the country.

The balance of the Swatara Exchange plan includes the development of nearly 50,000 square feet of complementary inline retail space and two new retail pad sites that will be marketed to restaurants, financial institutions, medical providers, convenience stores and other users to support the daily needs of the surrounding community and Swatara Exchange tenant and employees. The former Toys R Us building at 3405 Paxton Street is currently being marketed for sale or lease and is attracting interest from both retail and non-retail businesses.

Demolition of the remaining structures is expected to begin in March 2024 and to be completed in just over one year, and is subject to changes based on market and other conditions. Mass grading will follow, and is scheduled to be completed by late 2025. Phase I building construction and tenant fit-out work will extend from fall 2025 to fall 2026. This activity coincides with PennDot’s ongoing capital project improvements, including the reconstruction of the Eisenhower Interchange designed to improve ingress and egress to Swatara Exchange.

Nationwide closure of enclosed shopping malls accelerates

According to CapitalOne Shopping Research, of the estimated 1,150 malls currently operating throughout the United States, “there may be as few as 150 malls still in operation by 2032, and that up to 87 percent of large shopping malls may close over the next decade. Two million square feet of mall space was demolished last year, and the average vacant mall sells at 43 percent below its acquisition price.” Department stores, which traditionally served as the primary anchor destinations for shopping malls and occupied up to 25 percent of the total space, are struggling as consumers increasingly shop online.

History of St. John Properties’ ownership of Harrisburg Mall

When St. John Properties acquired Harrisburg Mall in a joint venture partnership in mid-2012, the mall was anchored by Macy’s, Bass Pro Shops and Great Escape Theatre. The company achieved significant leasing success at the regional mall by attracting national retailers 2nd & Charles and Destination XL in 2013, while also executing a $1 million renovation and improvement program that focused on the installation of new signage and exterior landscaping. Macy’s added its Macy’s Backstage concept in 2016 but, as part of a national closure strategy, ceased operations in 2020. Regal Entertainment acquired Great Escape Theatre and shuttered its Harrisburg Mall location in 2021.

“While some retail shopping centers continue to perform successfully, the pandemic and rise of e-commerce have taken their toll on enclosed malls. It has become apparent that the best use for this property isn’t pure retail, but rather a business community with a diversified mix of uses,” Maykrantz added. “Swatara Exchange will emerge as a long-term job generator and hub for businesses small and large. This redevelopment will add to the local tax base while contributing significantly to the economic health of the entire region. We are confident that this project will inject valuable amenities, services, and new vitality to the area.”

Founded in 1971, St. John Properties, Inc. is one of the nation’s largest and most successful privately held commercial real estate firms. The company is distinguished by its commitment to customer service, achievements in green building, and top-rated workplace culture. Throughout St. John Properties’ 52-year history, the company has developed more than 23 million square feet of flex/R&D, office, retail, and warehouse space, and has investments in over 3,000 residential units. The company proudly serves more than 2,500 clients in Colorado, Florida, Louisiana, Maryland, Nevada, North Carolina, Pennsylvania, Texas, Virginia, Utah, and Wisconsin. For more information about the company, visit www.sjpi.com.